Easy home budgeting

by Susan Katz

The

very word "budget" sends some people running up that hill. But the otherwise

odious task of planning your expenses need not be so painful. Here, START

presents a six-step plan and a set of home budget templates to let you

tame that raging beast called "the home budget."

The

very word "budget" sends some people running up that hill. But the otherwise

odious task of planning your expenses need not be so painful. Here, START

presents a six-step plan and a set of home budget templates to let you

tame that raging beast called "the home budget."

You'll find the budget templates for this article in the file called BUDGET.ARC on your START disk.

Budget. Just the mention of it drives people in the other direction, over the hill, and into the mile-high pile of bills, real or imagined. It's the stuff of which Blondie and Dagwood cartoons are made, the tripper-upper of otherwise noble people, more guilt-instilling than Jack's mother in "Jack and the Beanstalk" was ever meant to be.

No wonder, then, that recent figures indicate that fewer than 1.5 percent of American households even have budgets.

But let's backtrack a second here. What if we gave it a different name? What if we called it a spending plan, a plan which would allow you to take the money you earn, spend it wisely, save it likewise, even invest some, and feel good about it at the end of the month?

Think of it. When was the last time you looked at your empty pocket and felt good about where the money went? You can feel good, of course, by making a spending plan-a budget-for your own or your family's needs. And you can do it even more easily with a spreadsheet on your screen.

Janice Holm Lloyd, extension specialist in Family Resource Management for the North Carolina Agricultural Extension Service, notes that few people have budgets of any kind- a fact I could vouch for in my own research. Money issues-and communication about money-are at the center of stress in many families.

Making a budget isn't a penance, though. Lloyd calls it "an enabling tool" and recommends a six-step plan to gain control over your money.

Step 1. Set goals for yourself.

Plan for that red Mercedes roadster. Or that new kitchen or beach vacation.

Identify the specific financial goals you want to achieve. Ask yourself,

"What do I want most?" That way, you'll be better able to get the most

out of what you have. Then put your goals into time frames: immediate,

a few months from now, in a year, in several years.

Will you need a new roof in two or three years? A new car? How about higher education for your children? And care for elderly parents? And your own retirement?

If your household includes more than one adult, have all adults do this independently with pencil and paper. Then share your lists and see how similar they are, and how much compromising you may have to do.

Step 2. Estimate your income.

List what you can expect to receive for the coming year. include sources

beyond your paycheck, but only those most likely to be ongoing. These might

include your paycheck, fees, interest, dividends, rental income, Social

Security, pension, trust income, alimony child support, etc.

Step 3. Analyze your expenses.

If you've been keeping a checkbook and paying for most big expenses

by check, your checkbook register will probably be your best source of

information here. Go through. item by item, and total up what you've been

spending for food, transportation, clothing, etc. The "etc." is up to you,

as each household is different, with a different set of needs and different

process for working with money.

What you're trying to do here is to come up with as realistic a picture of your current spending patterns as you can. As an organizational expert once said to me about clutter, "This is not a moral statement!" This is a look at where you've been spending your money.

If you haven't been keeping much of a record of expenses, you'll have to "guesstimate." Remember that a budget is not fixed in concrete; it is an ongoing process-a living, breathing, flexible process. If you start out with a "guesstimate" and begin keeping tabs of your spending patterns, you'll soon have a firmer idea of where your money's going. No more guessing. And when you want to plunk down the money for the fulfillment of your dreams, you just may have it.

Here's where your spreadsheet will begin to come in handy. After you've looked at your expenses, group them into categories that make sense to you (food, transportation, housing, clothing, health, etc.). Does car insurance fit best for you under "transportation" or under "insurance"? How about health insurance? You can find as many different ways of categorizing as there are financial consultants. Do what makes sense to you.

Be sure to include savings and taxes. Uncle Sam'll get the latter, you get the former.

Start with one month. Some of your expenses will be fixed-i.e., a set amount each month (rent or mortgage payment, taxes, savings and investments). Others will be monthly flexible expenses (food, utilities, phone). Still others may be periodic (like health or car insurance, tuition, medical expenses). The rest are discretionary (clothing, home improvements, gifts and entertainment).

For your own purposes, you might choose to list your expenses according to your own categories. Decide how you want to fit these into your spending plan. Do you want to take the total amount, divide by 12, and include that in your monthly budget? Or do you want to include the lump quarterly sum once per quarter? Some advisors recommend, at the beginning, the divide-by-12 method, so you're not hit every third or sixth month with a large payment.

Likewise, Janice Lloyd recommends that if you live in an area of varying seasons, you take the energy company up on their offer to send you a flat-rate bill per month, letting the energy company take care of divvying that bill by 12 and allowing you the luxury of not having to worry when your electric bill jumps from $40 to $170 per month over a three-month period.

Step 4. Enter income and expenses on a spreadsheet.

Entering these figures on a spreadsheet, you have the easy option of

jockeying figures around. Once you've set down your amounts in each category,

for instance, you can easily see what happens to the other totals it you

buy a car with a larger car payment. Or if you decide to cut back on restaurants

and alter your food budget accordingly.

Because spreadsheets are relational (numbers in one column affect numbers elsewhere), and because spreadsheet programs do the math for you, you don't have to spend hours penciling all your numbers in only to change your mind later and have to erase and recalculate all your previous figuring.

expert once said about

clutter, "This is not

a moral statement!"

Step 5. Keep a record of your spending.

Again, you can do this in whatever way works best for you. Two methods

that many people have found work well are the cash-flow spreadsheet system

and the accounts system.

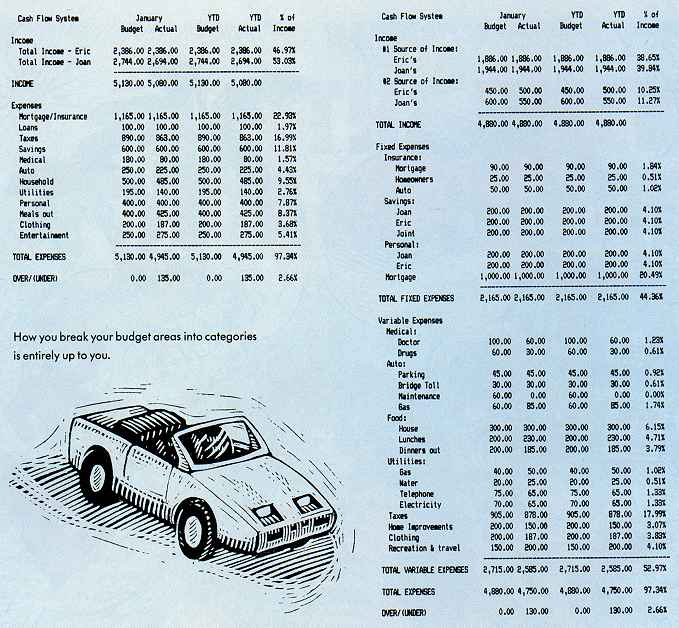

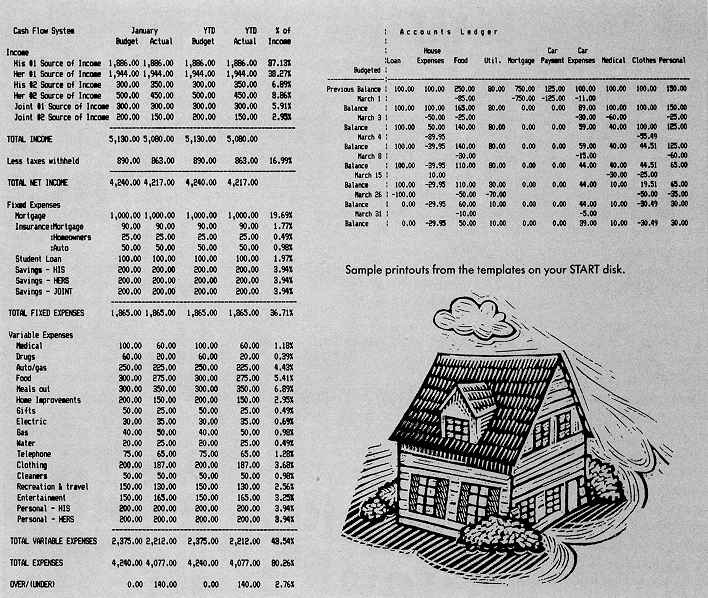

With the cash-flow spreadsheet system, make a list of months as column headings across the top of your screen, with two columns under each month: Budget (what you've planned to spend) and Actual. If you're new to this, you may want to start out with days instead of months, so you can readily track your spending patterns over time. Then at the end of the month, you can enter your totals of what you actually spent under the column marked 'Actual."

Down the lefthand side, make a list of your income and expenses by the categories you've devised - either alphabetical, by fixed categories vs. flexible, or whatever's easiest for you to understand and remember

Look at a calendar; try to remember your periodic expenses (and mark them down) and anticipate ones that might not be imminent. Include installment loan payments on the month they're due, or, alternatively, figure out the total for the year and divide by 12, entering that amount in your monthly expenses. (Some people keep money set aside for periodic expenses in separate checking accounts so they won't be tempted to dig into it when, in the meantime, another category runs dry.)

If you get in the habit of keeping receipts in one convenient place, you'll make your bookkeeping easier. Some people use the old standby, the shoe-box, for tossing receipts into. Just make sure it's in a convenient place so the entire family can get used to dropping their receipts into it. Write on your receipts what they're for; it'll make your life much easier when time comes to record them. Then, once a week or once a month, whenever you've designated for bookkeeping, transfer the receipt amounts onto the spreadsheet under the "Actual" column.

See how it works?

A second system is called an accounts system. This is a variation on the old "sugar-bowl" or envelopes system, where one jar or envelope was earmarked for the rent, another for groceries, etc.

To set up an accounts system, list your expenses across the top of the spreadsheet, along with how much you've allocated to spend in each category Down the lefthand side, start with a row marked "previous balance," and follow down the list by days of the month. As you spend money during the month in the various categories or add money to be budgeted, enter the information and subtract or add accordingly, keeping running totals as you go.

In an accounts system, balances are carried over from one month to the next, making it less exact than the previous system.

Creating the budget's the hard part. Keeping track of it is the payoff- watching where the money's going so you can be actively involved in how much goes for what and begin to feel in control of your cash flow instead of giving that control over to the phone company or Bloomingdale's.

Now you'll be in a position to watch what's happening and compare. What were your actual expenses compared to what you thought they were going to be? With a computerized spreadsheet, you can easily do the arithmetic required to find out either the dollar amount you're over or under for each category, or the percentage over or under Your computerized spreadsheet will also keep running year-to-date totals as well as project how you're doing for the year.

Whichever record-keeping system you use, computerizing it means you can see at a glance exactly where your money is and where it's been.

Remember the keyword flexibility. Again, your computerized spreadsheet comes in handy. After you've been keeping your budget for a month, you'll begin to see your actual patterns of spending and adjust accordingly. Not enough left over last month for dinner and the movies you'd been counting on? Maybe a shift in spending at the office Coke machine would offset enough quarters to add up to movie tickets by the end of the month.

Thinking of taking another job? One that involves a longer commute, a different wardrobe, and different childcare arrangements? Plug those projected items into your budget and see the lull impact of the financial changes on your spending plan. Now you can look at it and see, in dollars and cents, whether the change would be worth it.

Wondering how you'll be able to afford college educations for your children?

With a keypress you'll be able to see the effect of various ways of cutting

back in some categories to add more to a new one called "education."

| YOUR START BUDGET TEMPLATES

by Tom Chandler The two budget templates described in this article are on your START Disk in the archive file BUDGET.ARC. Copy this file and the program ARCX.TTP to a fresh disk. Double-click on ARCX.TTP. and in the box that comes on the screen, type the filename BUDGET.ARC and press the Return key. The disk will spin for a minute or so, the program will print messages onscreen to tell what it's doing, and when it's finished you'll find the spreadsheet templates on the disk. There are two copies of each spreadsheet-one for VIP Professional and one for A-Calc Prime. First, decide which budget method - the cash flow analysis (the file is called BUDGET1) or the accounts ledger system (the filename is BUDGET2)-you are most comfortable with. Next, load the template into your spreadsheet program following the instructions in your spreadsheet manual. The A-Calc Prime files have the extender .SPD; the VIP Professional flies have the extender .WKS. We have provided templates that will get you started on your budget. but to develop a system that will suit your individual needs you will want to customize the template. Break down your budget categories in ways that make the most sense to you. If you are using the accounts ledger system, adjust it so that spending and deposit amounts are entered daily, weekly, or whatever is most convenient. (In the example on disk, we have entered dates three or four days apart; you may want to prepare rows for each day of the month, or fill in the dates as you go along.) After you have customized the template, be sure to save a copy without any amounts filled, to use as a blank for the next budget period. ACCOUNTS LEDGER

CASH-FLOW SYSTEM

MEMORY REQUIREMENTS FOR

If you are using the accounts ledger system and want to make the template longer, you can insert new rows for entering amounts in the middle or at the end of the template. Simply position the cursor immediately below the previous balance and press Alt-A. VIP will enter a new row for entering amounts along with a new row to show the balance. To add another budget category position the cursor where you want the new category to be and then press Alt-C. To delete a category simply follow your manual's instructions on deleting a column VIP Professional will load either template if you have a 520 ST without

a memory upgrade. However, you won't have much memory to spare if you want

to make the template much larger. If you have a lot of budget categories,

you may want to save space by having a separate template for each budget

period.

PRODUCTS MENTIONED

* A-Calc Prime, $59.95. Antic Software, 544 Second Street. San Francisco, CA 94107, (415) 957-0886; (800) 234-7001. |

With all this attention to detail. budgeting does not need to be relentless. Says Lloyd, "We never recommend accounting for every single penny. Close is good enough for us. At the end of the month, set aside an hour or two for bookkeeping time (it's a household chore someone's gotta do, just like cooking food). Depending on how good your spreadsheet is, the ease of running expenses can be enormous. Fill in what your totals were for the month and sit down immediately to compare actual totals vs. projected."

After you've been doing this a while, you may be surprised to find your actual expenses in some categories equalling less than what you'd projected.

Step 6. Analyze and adjust.

From the information you have from step 5, make changes in your budget.

With a computerized spreadsheet, you're only a couple of keypresses away.

and you can "undo" changes mat don't look as if they'll work for you until

you come up with a solution you think will.

If you had more income than you expected, what are you going to do with it? You can readily see on your spreadsheet the effect of adding different amounts to your different totals.

If expenditures exceeded your projections, what were those categories? Why did it happen? Does the budget need to be adjusted to allow more for this category?

This step-analyze and adjust-is you taking the reins. This is you deciding the difference at the end of the month between a groan and a grin.

GENERAL THOUGHTS

Who should do the bookkeeping? The one who likes it the most-or hates

it the least. If no one enjoys it, agree to take turns. Some people like

doing this. Sometimes it's also the person who's the most computer-involved.

Sometimes it's not.

An important aspect of budgeting for a family is that it's a process that helps a family run smoothly. Everyone has a stake in it, and everyone's involved in it, even if only one person is the designated bill-payer.

If you've worked out a system with input from every adult and only one person is the designated bookkeeper, it's not fair to make the bill-payer the "heavy," the one who says no all the time. Treat the family bookkeeping as a job, and the person who does it as contributing that job to the family, with everyone sharing in the responsibility for decisions about spending money.

Include savings in your budget, regardless of how much you have to trim other categories. It's the carrot on the stick that makes all the drudgery of the rest of it worthwhile. Aim in your savings for two to six months' living expenses, expecting the unexpected. (How large a nest egg depends, according to Lloyd, on "what you're willing to do, what kind of training you would need, and your temperament.")

Include a category marked "personal" that nobody has to account for. "It will avoid turning this into a depressing, weary exercise," says Lloyd.

Think you can't create a budget because your income is erratic? "The

more uncertain your income," says

Lloyd, "the greater your need for a plan."

Want to regain control over your income and expenditure? Want to be able to look at where your money went and feel good about it? Then set up your spreadsheet and make a spending plan-a budget that works for you and your family. Give it an honest shot. With a computerized spreadsheet, you're already ahead of the game.

If you'd like more articles like this, circle 203 on the Reader Service Card.

Susan Katz is full-time writer. Her computer column, "Home Tech," appears monthly in the Raleigh, NC Spectator.